Table of Contents

- Navigating the Australian Tax Brackets in 2024: A Comprehensive Guide

- 2024 tax brackets: IRS inflation adjustments could save you money

- 2024 Tax Bracket Changes Could Mean More Money In Your Pocket Next Year ...

- 2024 Standard Tax Deduction Head Of Household 2024 - Gretal Idaline

- IRS announces 2024 income-tax brackets: Here’s what they mean for your ...

- Maximize Your Income by Understanding New 2024 Tax Brackets | Rise2Be

- Trump’s tax cuts could expire after 2025. Here’s how top-ranked ...

- Brenda Arriaga on LinkedIn: 2024 Tax Brackets

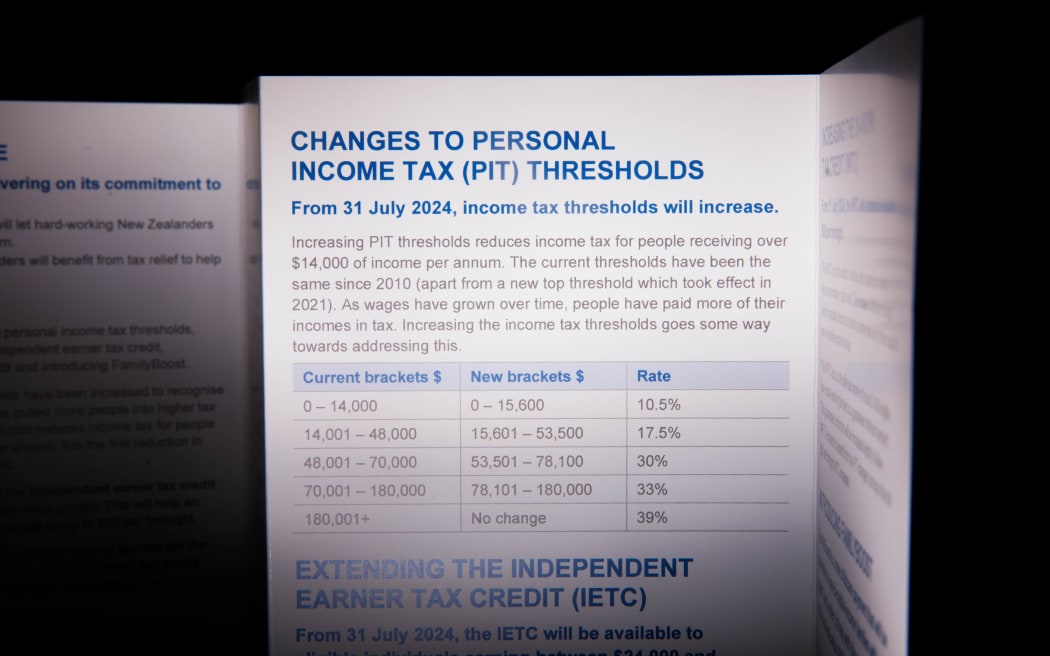

- Budget 2024: Here Is How To Calculate Your Tax Relief

- WATCH: Budget 2024 - Implications for unchanged tax brackets

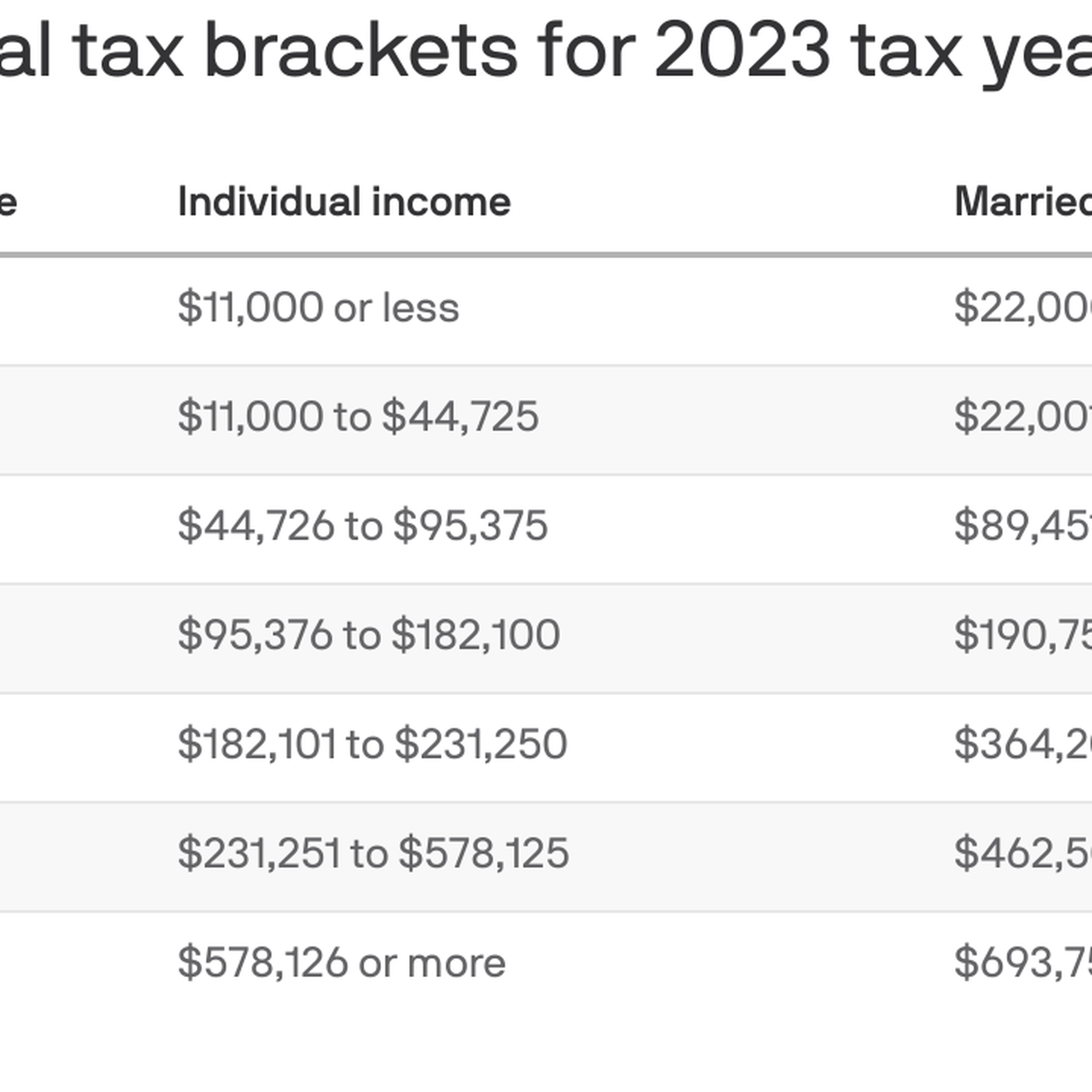

2024 Federal Tax Brackets and Rates

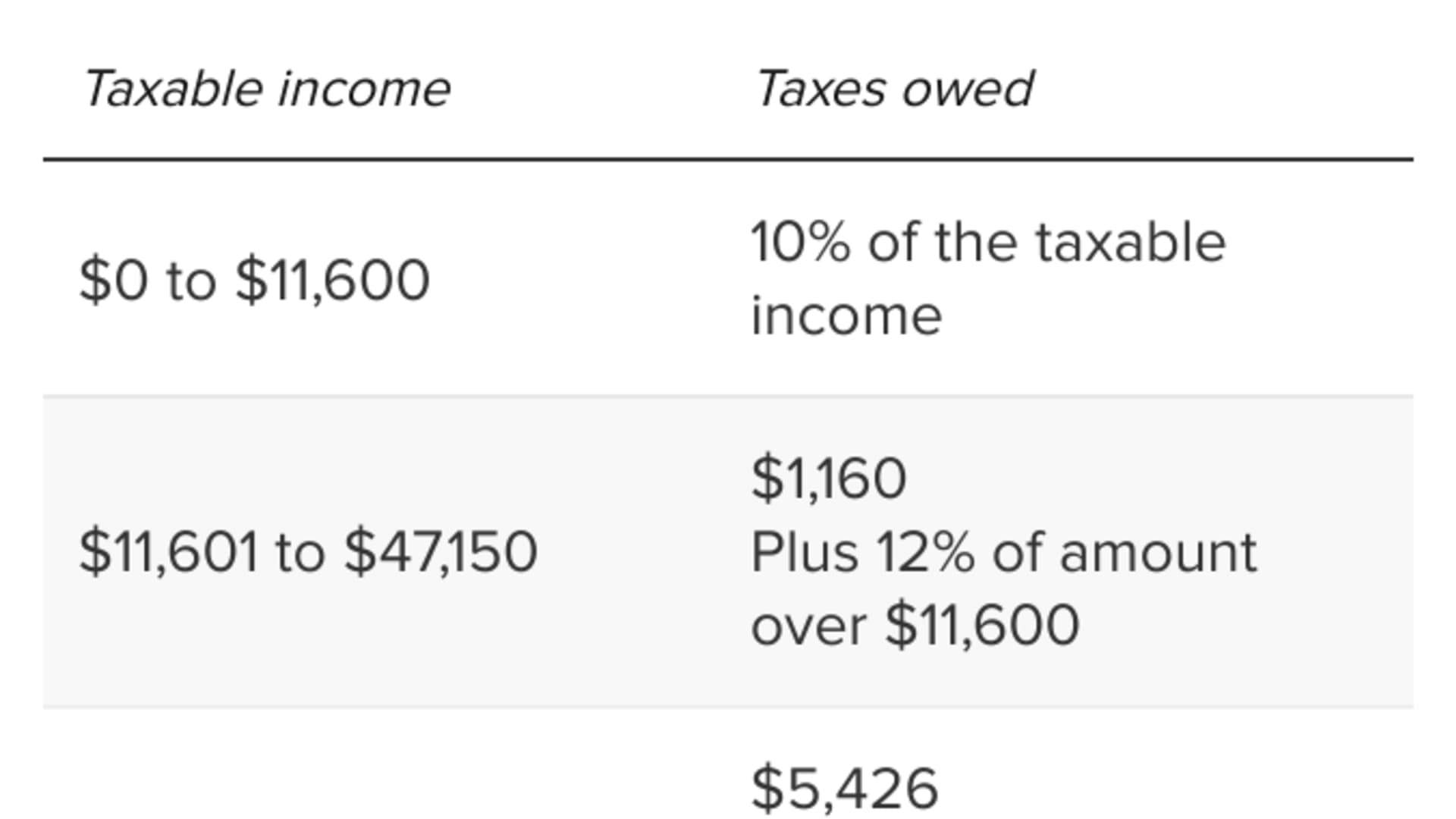

How the 2024 Tax Brackets Work

Key Takeaways for Taxpayers

Understanding the 2024 tax brackets is crucial for taxpayers to make informed decisions about their finances. Here are some key takeaways: Taxpayers should review their tax withholding to ensure they are not overpaying or underpaying their taxes. The 2024 tax brackets may impact tax planning strategies, such as income deferral or acceleration. Taxpayers should consider consulting a tax professional to ensure they are taking advantage of all available tax deductions and credits. The 2024 tax brackets and rates provide a framework for taxpayers to understand their federal tax obligations. By staying informed about the latest tax changes, taxpayers can make informed decisions about their finances and minimize their tax liability. Whether you're a individual taxpayer or a business owner, it's essential to stay up-to-date on the latest tax developments to ensure you're in compliance with federal tax laws. Visit the Tax Foundation website for more information on the 2024-2025 federal tax brackets and rates.This article is for informational purposes only and should not be considered tax advice. Consult a tax professional for personalized guidance on your specific tax situation.